For beauty enthusiasts and frequent Ulta shoppers, the Ulta Credit Card offers rewards and perks that enhance your shopping experience. However, to fully enjoy these benefits, it’s essential to know how to access and manage your account online. This guide provides a comprehensive overview of the Ulta Credit Card login process, steps for registration, troubleshooting common issues, and tips for managing your account efficiently.

Steps to Log in to Your Ulta Credit Card Account

Managing your Ulta Credit Card account online is quick and hassle-free. By following a few simple steps, you can log in to your account and take advantage of its features. This guide will walk you through the process so you can easily view and manage your card details.

1. Visit the Official Login Page

Start by going to the official Ulta Credit Card website, managed by Comenity Bank, at comenity.net/ultacreditcard. This secure portal is where you can manage your credit card online.

2. Enter Your Login Credentials

Once on the login page, enter the following details:

- Username: Provide the username you created during the account registration process.

- Password: Carefully type in your password. Ensure there are no typos, as passwords are case-sensitive.

3. Click “Sign In”

After entering your credentials, click the “Sign In” button to access your account dashboard. If your credentials are correct, you will be redirected to your account management page, where you can view and manage your card details.

First-Time User? Register Your Ulta Credit Card for Online Access

If you are a first-time user of the Ulta Credit Card and have not yet registered for online access, the process is simple and straightforward. Registering for online access allows you to manage your account, make payments, track rewards, and update personal information at your convenience. Follow the steps below to get started with registering your account online.

1. Go to the Registration Page

To begin the registration process, you need to visit the official Ulta Credit Card login page. On this page, look for the “Register for Online Access” link. Clicking this link will take you to the registration form, where you will enter the necessary details to set up your account. This is the first step in gaining full access to all the features and tools available for managing your Ulta Credit Card online.

2. Provide Your Personal and Card Information

To verify your identity and set up your account, you’ll need to input the following details:

- Your credit card account number (found on your card or statement)

- Your ZIP code

- Your Social Security Number (SSN) or another form of identification requested

3. Create a Username and Password

Once your personal and card information is entered, you will be prompted to create a username and password for your online account. It’s important to choose a secure and memorable username, as this will be used each time you log in. When creating your password, make sure to include a combination of uppercase and lowercase letters, numbers, and special characters. This will strengthen your password and protect your account from unauthorized access. A strong password is essential for securing your account and ensuring your personal information remains private.

4. Set Up Security Questions

To further enhance the security of your account, you will be asked to choose and answer a set of security questions. These questions are designed to help verify your identity in case you forget your password or need assistance with your account in the future. It’s important to choose questions and answers that are both memorable and unique. Make sure the answers are something only you would know, as this will help protect your account from being accessed by others.

5. Complete the Registration Process

After filling out all the required information, carefully review the details you’ve entered to ensure everything is correct. Once you are sure all the information is accurate, complete the registration process. You will now be able to log in using the username and password you just created. This will grant you access to your Ulta Credit Card account, where you can track transactions, manage payments, check your rewards points, and update your personal information whenever necessary.

Troubleshooting Common Login Issues

Sometimes, logging into your Ulta Credit Card account can present challenges. However, most issues can be resolved with simple troubleshooting steps. Whether you’ve forgotten your login credentials or encountered technical difficulties, follow the steps below to regain access and get back to managing your account.

1. Forgot Username or Password?

If you’ve forgotten your login details:

- Click the “Forgot Username/Password” link on the login page.

- You’ll be prompted to enter your credit card account details, such as your account number and ZIP code, to verify your identity.

- Once verified, you’ll receive instructions to reset your password or recover your username.

2. Locked Account

If your account is locked due to multiple failed login attempts, it’s important to act quickly. To unlock your account, you will need to contact Comenity Bank’s customer service. They will guide you through the process of unlocking your account and resetting your login credentials if necessary. This extra layer of security is in place to protect your account from unauthorized access, but the customer service team will ensure that you can access your account again as soon as possible.

3. Technical Issues

Technical problems can also prevent you from logging in. To resolve these, start by ensuring that your internet connection is stable. If the connection is fine, check whether your browser is up to date. An outdated browser may cause issues with the login process. Additionally, clearing your browser’s cache and cookies can help eliminate any glitches that may be interfering with the login process. These quick fixes usually resolve most login issues and help you access your account without further problems.

Features and Benefits of Managing Your Ulta Credit Card Account Online

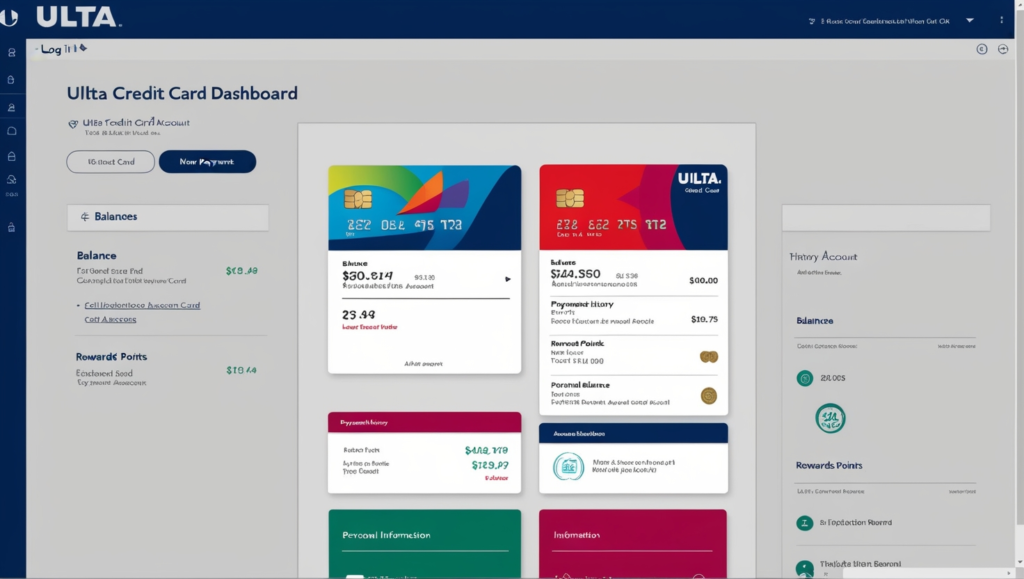

Managing your Ulta Credit Card account online is straightforward and convenient. By logging into your account, you gain access to a range of features designed to simplify account management. These tools not only help you keep track of your spending but also ensure that your account is up to date. Whether you’re monitoring rewards, making payments, or keeping your contact information current, these features make it easier to manage your finances efficiently. Below are the key features available to you once you’ve logged into your Ulta Credit Card account.

1. View Account Balance and Payment History

One of the most important features of managing your Ulta Credit Card online is the ability to view your balance and payment history. By regularly checking your balance, you can stay on top of your spending and avoid surprises. You’ll also be able to see any recent transactions, helping you track purchases and manage your budget effectively. Payment history is equally important as it shows the payments you’ve made toward your balance, giving you an idea of your progress. Keeping an eye on these details helps with financial planning and ensures that you don’t miss any payments. Tracking this information online is far more convenient than relying on paper statements, making it easier to stay organized.

2. Track Ultimate Rewards Points

The Ulta Credit Card is connected to the Ultimate Rewards Program, a major benefit for shoppers. By logging into your account, you can track your rewards points in real time. The dashboard will show how many points you’ve accumulated, as well as how close you are to earning discounts or rewards for future purchases at Ulta. Monitoring these points online makes it easier to decide when and how to redeem them for discounts on Ulta products and services. Additionally, seeing your rewards points grow can encourage you to continue making purchases, knowing that each transaction brings you closer to rewards. This is a great feature for frequent Ulta shoppers who want to maximize their benefits.

3. Schedule and Make Payments

The Ulta Credit Card account management portal offers several options for making payments, ensuring you can always stay on top of your bills. One of the key features is the ability to schedule automatic payments. This is a convenient option for those who want to ensure their payment is made on time every month, without having to remember to log in. For more flexibility, you can also make one-time payments whenever you choose. You have control over how much to pay, whether it’s the minimum payment, the full balance, or a custom amount. This flexibility makes it easier to stay on top of your finances, avoid interest charges, and keep your credit score healthy. Managing your payments online also eliminates the need for paper checks, saving you time and effort.

4. Update Personal Information

Another convenient feature of managing your Ulta Credit Card online is the ability to update your personal information. Life changes such as moving to a new address or changing your phone number can be easily updated through the account portal. Keeping your information current ensures that your billing statements, notifications, and any other important communications are sent to the correct address. You can also update your email address, ensuring that you receive timely account alerts and promotions. By regularly reviewing and updating your personal details, you ensure that your account runs smoothly and that you’re always notified of important account updates.

5. Enroll in Paperless Billing

If you want to simplify the management of your Ulta Credit Card account and reduce waste, you can enroll in paperless billing. Paperless billing allows you to receive your credit card statements securely via email instead of through traditional mail. This not only helps you stay more organized but also reduces your environmental footprint by eliminating the need for printed statements. Paperless billing ensures that you receive your statements as soon as they are available, giving you instant access to important details like your balance, due date, and payment options. Additionally, opting for paperless billing is often more secure than waiting for physical mail, which could be lost or stolen.

6. Set Up Alerts and Notifications

Finally, setting up alerts and notifications is a useful feature that helps you stay informed about your account activity. You can enable email or text alerts to receive reminders about upcoming payment due dates, recent transactions, or any suspicious activity on your account. Alerts can be tailored to suit your preferences, ensuring you only receive the notifications that are most relevant to you. This feature is particularly helpful for those who have a busy lifestyle and want to ensure they never miss a payment or overlook an important account update. By enabling alerts, you can maintain better control over your finances and ensure your account stays secure.

Security Tips for Managing Your Account

Protecting your Ulta Credit Card account and personal information is essential to prevent unauthorized access and keep your financial details secure. By following a few simple steps, you can add layers of security to your account, ensuring your data stays safe. Here are four key practices to help safeguard your account.

1. Use a Strong Password

A strong password is one of the most effective ways to protect your account. When creating your password, ensure it includes a mix of uppercase and lowercase letters, numbers, and special characters. This makes it much harder for anyone to guess. Avoid using common information such as your name, birthdate, or easily accessible details that can be found online. The more complex your password, the stronger the protection it offers. Make sure to update your password regularly and never share it with others. A strong, unique password significantly reduces the risk of unauthorized access to your account.

2. Enable Two-Factor Authentication (2FA)

Two-Factor Authentication (2FA) adds an extra layer of security to your login process. When enabled, you’ll be required to provide a second piece of information—such as a code sent to your phone or email—along with your password. This makes it much more difficult for hackers to access your account, even if they have your password. 2FA ensures that only you can log into your account, even if someone else knows your login credentials. It’s a simple and highly effective method to protect your personal information from potential threats.

3. Log Out After Use

It’s crucial to log out of your account when you’re finished using it, especially if you’re on a shared or public device. Leaving your account open increases the chances of unauthorized access, whether it’s by someone you know or a stranger who uses the same device. By logging out after each session, you ensure that no one can easily access your account without your login credentials. This is a quick and simple step to protect your personal and financial data.

4. Monitor Account Activity

Regularly checking your account for any unauthorized transactions is essential for detecting potential fraud. Keep an eye on your recent purchases and review your payment history to ensure everything looks correct. If you notice any suspicious activity, report it immediately to customer support. Monitoring your account frequently can help you catch and address issues early, preventing further damage. It’s better to act quickly and report any concerns to ensure your account remains secure.