Budgeting plays a vital role in personal finance, helping individuals stay on top of their income and expenses. By understanding where your money goes, you can make smarter financial decisions and work toward achieving your goals.

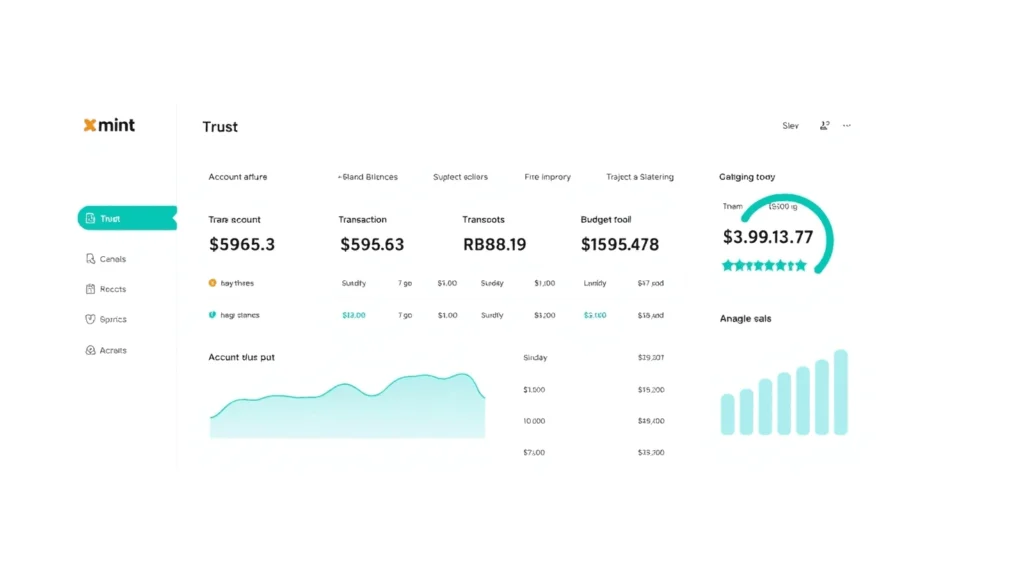

With technology at our fingertips, budgeting apps have made managing money easier and more efficient. These tools offer real-time expense tracking, goal setting, and insights that can transform how you handle your finances.

In this blog, we’ll showcase the top 10 best budgeting apps for 2025. Whether you’re a beginner or looking for advanced features, this list will guide you to find the perfect tool to fit your financial needs. Learn more about managing money effectively with these apps at ConsumerFinance.gov.

Why Budgeting Apps Are Essential for Financial Management

The Rise of Personal Finance Apps

Budgeting apps have become increasingly popular in recent years. They provide a convenient way to manage finances directly from your smartphone or computer. With these tools, users can track expenses, monitor income, and set financial goals all in one place. One of the biggest advantages is real-time tracking. This feature helps you see where your money goes, allowing you to make informed decisions instantly.

Automation is another major benefit. Many budgeting apps sync with your bank accounts, categorizing transactions automatically. This saves time and reduces the chance of errors. For example, apps like Mint and PocketGuard streamline expense tracking, making them some of the best budgeting apps available today. Learn more about budgeting basics to see why these tools are essential.

Key Features to Look for in Budgeting Apps

When choosing a budgeting app, it’s important to consider the features that will meet your financial needs. Expense tracking is a must-have. It allows you to see your spending habits and identify areas where you can cut back. Goal setting is another crucial feature. Apps like YNAB (You Need a Budget) help users set and achieve financial goals, such as saving for a vacation or paying off debt.

Bill reminders are equally essential. Late payments can lead to fees and hurt your credit score. Apps like EveryDollar send alerts to ensure you never miss a payment. Choosing the best budgeting apps with these features can make managing your finances much easier. Explore more about financial management tools to discover additional app recommendations.

By incorporating these features into your financial routine, you’ll have greater control over your money and be better prepared for future expenses.

Top 10 Best Budgeting Apps for 2025

Mint – Best for Beginners

Mint is one of the best budgeting apps, especially for those new to managing their finances. It’s a free app with a user-friendly interface, making it simple to track expenses. Users can connect their bank accounts, credit cards, and bills to get a complete view of their financial picture. Mint also offers budget recommendations based on spending habits and sends alerts for bill payments and unusual account activity.

To learn more about Mint and its features, visit Mint’s official website.

YNAB (You Need A Budget) – Best for Advanced Budgeting

YNAB stands out as one of the best budgeting apps for users with more advanced financial goals. Unlike other apps, YNAB focuses on proactive budgeting by encouraging users to assign every dollar a purpose. This approach ensures your money works efficiently toward your priorities. Though it’s a subscription-based app, many users find its goal-oriented tools and financial insights worth the investment. YNAB also provides educational resources to improve budgeting skills.

Explore YNAB in detail on their official website.

PocketGuard – Best for Expense Tracking

PocketGuard is ideal for those who want to focus on controlling their spending. It simplifies budgeting by showing how much disposable income you have after covering bills and necessities. This makes it one of the best budgeting apps for avoiding overspending. The app categorizes transactions, helps identify savings opportunities, and offers tools to set spending limits. PocketGuard’s clean design and straightforward features make it easy for users to stay on top of their finances.

Discover more about PocketGuard by visiting PocketGuard’s website.

These three apps showcase a variety of features tailored to different budgeting needs, making them excellent choices for managing your money in 2025. Whether you’re a beginner, a financial pro, or focused on tracking expenses, these tools can help you achieve your goals.

Free vs. Paid Budgeting Apps: Which Is Right for You?

When it comes to budgeting apps, there are both free and paid options available. Each type has its advantages and drawbacks, depending on your financial needs and goals. Let’s take a closer look at the pros and cons of both free and paid budgeting apps.

Free Budgeting Apps:

Free budgeting apps, like Mint and Goodbudget, are a great starting point for anyone new to personal finance management. They are widely accessible, and many offer core budgeting features at no cost. For example, Mint is one of the most popular free budgeting apps available. It automatically pulls in your bank transactions, categorizes your spending, and gives you a clear view of your finances. Goodbudget, on the other hand, operates on an envelope-based budgeting system, allowing you to manually track your expenses. This method is ideal for people who prefer a hands-on approach.

However, free budgeting apps often come with limitations. While they provide essential budgeting tools, you may not have access to advanced features, such as personalized financial advice or in-depth reporting. Some free apps may also include ads, which can be distracting. Additionally, you may face restrictions on features like syncing multiple accounts or setting financial goals.

Despite these downsides, free apps are a solid option for those who are just starting out or who don’t need extensive functionality. They can provide a good foundation for budgeting, especially if you’re looking for simple tools to track your spending.

Paid Budgeting Apps:

Paid budgeting apps, such as YNAB (You Need A Budget) and EveryDollar, offer more advanced features that go beyond basic expense tracking. With YNAB, for example, you get a proactive approach to budgeting. The app encourages users to allocate money to specific categories and helps prioritize financial goals, such as paying off debt or saving for emergencies. EveryDollar, developed by financial expert Dave Ramsey, offers a straightforward approach to budgeting, with a focus on zero-based budgeting, where every dollar is assigned a specific role.

While paid apps offer enhanced functionality, they also come at a cost. Typically, these apps require a subscription, which can range from $5 to $12 per month, depending on the app and the features you choose. However, the benefits can justify the price. For instance, YNAB offers detailed financial reports, bank account syncing, and the ability to set financial goals. This can be particularly helpful if you want to dive deeper into your spending habits and track your progress over time.

On the downside, the subscription fees may be a barrier for some users. While paid apps often offer free trials, you may need to decide whether the advanced features are worth the investment. Additionally, some users may find the learning curve for these apps a bit steeper than with simpler, free tools.

In conclusion, deciding between free and paid budgeting apps depends on your needs. If you’re looking for basic tracking and aren’t ready to commit to a paid service, free apps like Mint and Goodbudget may be perfect for you. On the other hand, if you want a more comprehensive and guided budgeting experience, paid options like YNAB or EveryDollar may offer the tools you need to achieve your financial goals.

How to Choose the Best Budgeting App for Your Needs

Choosing the best budgeting app depends on your personal financial goals, the platform you use, and the features you value most. It’s important to consider these factors to find an app that aligns with your specific needs.

Consider Your Financial Goals

The first step is to think about your financial objectives. Do you want to save for a house, pay off debt, or simply manage family finances more effectively? Each goal requires different features from a budgeting app. For instance, if you’re focused on saving for a big purchase, look for apps with goal-setting capabilities. On the other hand, if you’re reducing debt, consider apps that track outstanding balances and payments. Understanding your goals will help you prioritize the tools that best support your financial journey.

Platform Compatibility

Another crucial factor is platform compatibility. Budgeting apps are available for different devices, including Android, iOS, and web browsers. You’ll want to choose an app that fits your lifestyle. If you primarily use a smartphone, check whether the app works seamlessly on both Android and iOS. Additionally, if you prefer accessing your budget on a computer, find an app with a web-based version. The best budgeting apps will ensure your information syncs smoothly across devices, giving you access wherever you are.

Feature Prioritization

Finally, focus on the features that matter most to you. Some people value real-time alerts that notify them about spending limits or upcoming bills. Others might prioritize graphs and visual tools to better understand their financial trends. Make sure the app includes the features that will help you stay on track. Look for apps with syncing options, so your financial data is automatically updated across all devices. A budgeting app should not only make it easy to track expenses but also offer tools that support your financial goals.

When choosing a budgeting app, think about what will make managing your money easiest. You can explore the best budgeting apps to find a tool that fits your needs. By considering your goals, the platform you use, and the app’s features, you’ll be well on your way to mastering your finances.

Conclusion

In this post, we’ve explored the best budgeting apps available in 2025, from free tools like Mint and Goodbudget to advanced options such as YNAB and PocketGuard. Each app offers unique features designed to help you manage your money effectively, whether you’re tracking expenses, setting financial goals, or reducing debt. Choosing the right app depends on your personal financial goals and preferences. Take time to explore the suggested apps and find the one that suits your needs best. Remember, the right app can make a significant difference in your financial journey. We’d love to hear from you! Share your favorite budgeting app in the comments below and let us know how it helps you stay on track with your finances. For more information on budgeting apps, feel free to check out additional resources on platforms like Mint and YNAB.