Planning for retirement can be overwhelming, but the right tools can simplify the process. Financial planning tools and calculators break down complex decisions into manageable steps. They help you estimate future needs, model different investment scenarios, and track your progress toward retirement goals. By using these tools, you can create a more accurate and effective plan. Whether you’re just starting or refining your strategy, understanding how these resources work boosts your confidence in achieving financial security. Explore Saving Strategies by Age to optimize your approach and stay on track.

Decade-by-Decade Savings Benchmarks: Practical Strategies for Each Life Stage

Saving for retirement is a lifelong journey, and knowing how much to save at each stage of life can make all the difference. By tailoring your saving strategies to your age and financial circumstances, you can build a solid foundation for a comfortable retirement. This guide outlines decade-specific savings goals to help you stay on track and achieve your financial objectives.

20s: Building the Foundation

In your 20s, the focus should be on creating an emergency fund and establishing a habit of saving. Aim to set aside at least three to six months’ worth of living expenses in a high-yield savings account for unexpected events. Simultaneously, start contributing to a retirement account, like a 401(k) or Roth IRA, even if it’s a small amount. A good rule of thumb is to save at least 10% of your income for retirement. If your employer offers a 401(k) match, contribute enough to maximize it, as this is essentially free money. Prioritize developing a budget to manage student loans and other early financial obligations while still making room for savings.

30s: Stepping Up the Savings

Your 30s are a critical time to increase your retirement contributions. Aim to save 15% or more of your income, including any employer contributions. This is also the time to diversify your savings. Consider investing in both tax-advantaged accounts like traditional IRAs and Roth IRAs, as well as taxable brokerage accounts. Use this decade to reassess your financial goals, such as buying a home or starting a family, and align your savings strategy accordingly. Don’t forget to evaluate your investment portfolio regularly to ensure it matches your long-term objectives and risk tolerance.

40s: Maximizing Contributions

By your 40s, retirement planning should be a top priority. If you haven’t started saving yet, it’s crucial to begin now and save aggressively. Take full advantage of annual contribution limits for accounts like 401(k)s and IRAs. Consider “catch-up” contributions if you’re behind on savings goals. Review your retirement plan periodically to ensure it’s on track, and adjust your budget to allocate as much as possible toward savings. Focus on paying down high-interest debt, as this will free up additional funds for retirement.

50s: Preparing for the Transition

In your 50s, it’s time to maximize your retirement contributions and take advantage of catch-up contribution allowances offered by many retirement accounts. Aim to save 20% or more of your income if possible. Begin planning for the transition to retirement by estimating your retirement expenses and evaluating your expected income streams. Seek professional financial advice to refine your strategy and address any gaps in your plan. Use this decade to build a robust financial cushion for unexpected healthcare or other expenses that may arise in retirement.

60s and Beyond: Enjoying the Rewards

Your 60s and beyond are when you start drawing down your savings to support your retirement lifestyle. Work with a financial advisor to create a sustainable withdrawal strategy that balances your needs with the longevity of your savings. Consider factors like required minimum distributions (RMDs) and tax implications when planning your withdrawals. Continue monitoring your investment portfolio to ensure it supports your income needs while maintaining some growth potential. Stay vigilant about budgeting and prioritize living within your means to make your retirement savings last.

For more tips and resources on saving strategies by age, visit Investopedia or AARP’s Retirement Planning.

The Power of Early Saving

Starting to save early is one of the most effective ways to build a secure financial future. It provides a head start in preparing for long-term goals, including retirement. Early saving is not just about setting aside money—it’s about maximizing the unique advantages that time and consistency bring to wealth accumulation. Here are three compelling reasons why starting early makes all the difference.

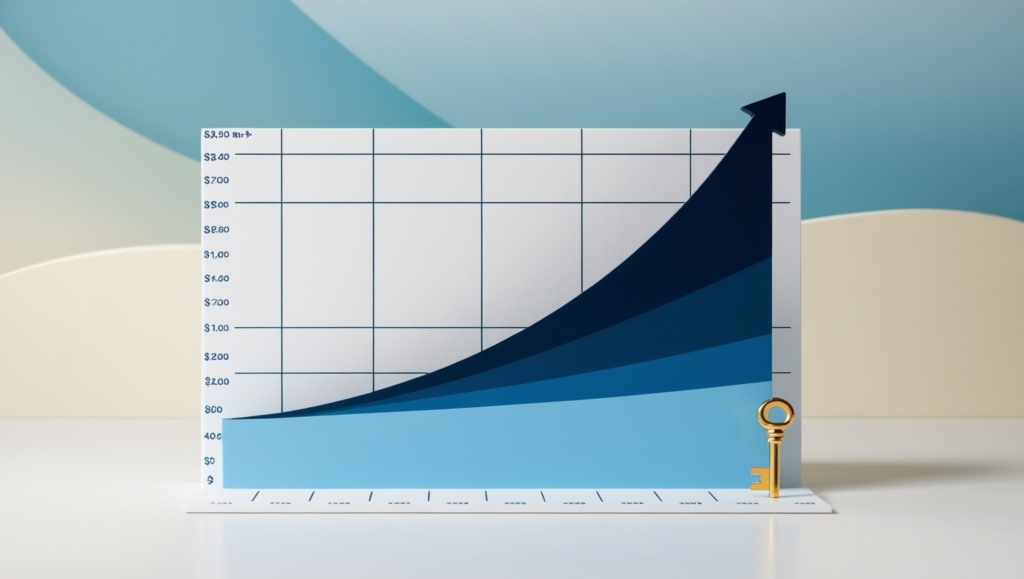

Compound Interest: Money That Works for You

One of the most significant benefits of saving early is the power of compound interest. This is the process where your investments generate earnings, and those earnings, in turn, generate their own earnings. For example, a small amount saved in your 20s can grow significantly over time compared to larger contributions made later in life. Starting early gives your money more time to grow, creating a snowball effect. To see how compound interest works, consider using tools like a compound interest calculator.

Time in the Market: Maximizing Growth Potential

The earlier you start saving and investing, the more time your money has to grow. Market fluctuations may occur, but time in the market helps smooth out these ups and downs. Over decades, investments in assets like stocks tend to yield higher returns. This long-term perspective is a core element of effective saving strategies by age. By beginning early, you allow your investments to take full advantage of market growth and reinvested dividends, leading to greater wealth accumulation.

Reduced Financial Stress: Peace of Mind for the Future

Knowing you have a financial safety net can significantly reduce stress. Early saving helps create a sense of financial security, providing peace of mind as you face life’s uncertainties. It ensures you are better prepared for emergencies, career changes, and retirement. Planning early also minimizes the pressure of having to save large amounts later in life to catch up.

Catching Up on Savings: Strategies for Late Starters

Starting late on retirement savings doesn’t mean you can’t achieve financial security. With strategic planning and focused actions, it’s possible to build a solid nest egg, even later in life. Whether you’re in your 40s, 50s, or beyond, these saving strategies by age can help you close the gap and prepare for a comfortable retirement.

Maximize Contributions to Retirement Accounts

One of the most effective ways to catch up on savings is by maximizing your contributions to retirement accounts. Take full advantage of annual limits on accounts like 401(k)s, IRAs, and Roth IRAs. If you’re 50 or older, you can make catch-up contributions, which allow you to contribute even more each year. For example, the IRS permits additional contributions beyond the standard limit, helping late savers boost their retirement funds. Check the latest contribution limits on resources like IRS Retirement Topics.

Invest Aggressively for Higher Returns

When you’re starting late, investing more aggressively can help your money grow faster. This may involve allocating a larger portion of your portfolio to stocks or other high-growth assets. While these investments carry more risk, they also offer the potential for higher returns. Work with a financial advisor to determine the right balance of risk and reward based on your time horizon and comfort level. Diversifying your investments can help mitigate risks while maximizing growth potential.

Reduce Expenses to Increase Savings

Cutting back on unnecessary expenses is another way to free up funds for savings. Review your budget and identify areas where you can reduce spending, such as dining out, subscriptions, or luxury purchases. Redirect these savings into your retirement accounts or other long-term investments. Adopting a frugal mindset doesn’t mean sacrificing quality of life—it’s about prioritizing long-term security over short-term gratification. For practical budgeting tips, visit NerdWallet’s Savings Guide.

Delay Retirement to Boost Benefits

Working longer is a powerful strategy for catching up on savings. Delaying retirement not only allows you to continue earning income but also increases your Social Security benefits. For every year you delay claiming benefits past your full retirement age, your monthly payout increases. Additionally, staying in the workforce gives you more time to contribute to your savings and reduces the number of years you’ll rely on them. Use tools like the Social Security Retirement Calculator to understand how timing your retirement affects your benefits.

Adjusting for Life Events: Adapting Your Savings Strategy

Life events often bring significant financial changes, requiring adjustments to your savings goals. Whether you’re getting married, buying a home, or starting a family, these milestones impact your budget and long-term plans. By proactively adjusting your saving strategies by age and circumstance, you can stay on track and achieve your financial objectives.

Marriage: Merging Finances for a Joint Future

Marriage is a major life event that can transform your financial situation. Start by combining your finances and creating a joint savings plan that aligns with your shared goals. Open communication about money is essential—discuss income, debts, and financial priorities. Consider setting up joint accounts for shared expenses while maintaining individual accounts for personal spending. This is also an excellent time to review your retirement contributions and ensure both partners are maximizing benefits, like employer matches. Use tools like Mint to create a joint budget and track your savings progress.

Homeownership: Balancing Savings and Housing Costs

Becoming a homeowner often means adjusting your savings rate to accommodate mortgage payments, property taxes, and maintenance costs. It’s important to account for these additional expenses while still prioritizing retirement and emergency savings. Consider building a dedicated fund for home repairs to avoid dipping into long-term savings when unexpected issues arise. Review your budget regularly and adjust discretionary spending to maintain a healthy balance between homeownership costs and your financial goals. For guidance, check out Zillow’s Homeownership Tips.

Children: Preparing for New Responsibilities

Starting a family brings new financial responsibilities, from childcare to education costs. Consider setting up a college savings plan, such as a 529 account, early on to take advantage of tax benefits and compound growth. While it’s important to plan for your children’s future, ensure that your retirement savings remain a priority. Remember, loans can fund education, but there are no loans for retirement. Reassess your budget and savings strategy to accommodate these changes, and seek professional advice if needed. Resources like Saving for College can help you plan effectively.

Irregular Income vs. Steady Salary: Adapting Your Savings Strategy

Saving strategies differ significantly depending on whether your income is irregular or steady. Tailoring your approach to fit your financial circumstances ensures you can consistently work toward your long-term goals. Understanding these differences and implementing effective methods can help you save effectively, no matter your earning pattern.

Saving with Irregular Income

For those with irregular income, such as freelancers or commission-based workers, it’s crucial to set a fixed percentage of your earnings aside each month. This approach helps you save consistently, even when income fluctuates. Use high-yield savings accounts for emergency funds or retirement savings accounts like IRAs for long-term goals. Automating your savings through transfers ensures discipline and prevents overspending during high-earning months. Additionally, during periods of higher income, consider saving a larger percentage to cushion against leaner months. Resources like NerdWallet’s Budgeting for Irregular Income Guide can provide further assistance.

Saving with a Steady Salary

If you have a steady salary, automate your savings to deduct a specific amount or percentage from each paycheck. This “pay yourself first” approach builds consistent savings without requiring constant decision-making. Allocate contributions to tax-advantaged accounts, such as a 401(k) or Roth IRA, to maximize growth and minimize taxes. Revisit your savings goals annually to adjust for salary increases or changes in financial priorities. For additional tools and tips, explore Fidelity’s Retirement Savings Guide.

Assessing Your Retirement Readiness

Evaluating your readiness for retirement is a critical step in achieving financial security. It requires understanding your future needs, analyzing your current savings, and making informed projections about income and expenses. By considering key factors such as lifestyle preferences, expected costs, Social Security benefits, and investment returns, you can create a realistic retirement plan tailored to your goals.

Envisioning Your Desired Lifestyle

Start by picturing the kind of lifestyle you want during retirement. Do you plan to travel extensively, move to a new city, or maintain your current living situation? Your vision directly impacts how much you’ll need to save. For example, a lifestyle involving frequent travel or a second home will require more savings than one focused on modest living. Creating a clear picture of your goals helps determine the financial resources needed to support them. Tools like the AARP Retirement Calculator can assist in outlining your vision.

Estimating Future Expenses

Next, estimate your retirement expenses. Account for major costs such as housing, healthcare, travel, and leisure activities. Don’t overlook inflation, which can significantly impact long-term expenses. For example, healthcare costs tend to rise faster than general inflation. Use current spending patterns as a baseline but adjust for anticipated changes in retirement, such as downsizing your home or increased medical care. Accurate estimates ensure you don’t underestimate your financial needs.

Factoring in Social Security Benefits

Include your expected Social Security benefits as part of your income. While these benefits may not cover all expenses, they can form a critical foundation for retirement income. Check your personalized benefit estimate using the Social Security Administration’s Benefits Calculator. Additionally, understand how factors like your retirement age affect payout amounts. Delaying benefits, for instance, can increase your monthly payments, providing more financial stability.

Making Realistic Assumptions About Investments

Finally, assess your investment portfolio and make realistic assumptions about returns. Avoid overly optimistic projections and instead use conservative estimates to ensure you’re not over-relying on market performance. Diversify your investments to balance growth potential with risk management. Regularly review your portfolio to align it with your age and risk tolerance. For tailored advice, consider consulting with a financial advisor or using tools like Vanguard’s Investment Planning Resources.

Leveraging Employer-Sponsored Plans for Retirement

Employer-sponsored retirement plans, such as 401(k)s, are powerful tools to help you build wealth for retirement. These plans offer unique advantages that can significantly enhance your savings. By taking full advantage of these benefits, you can boost your retirement fund while enjoying tax advantages and professional investment management.

Employer Match: Free Money to Boost Your Savings

One of the biggest advantages of employer-sponsored plans is the employer match. Many companies offer to match a percentage of your contributions, effectively providing you with free money. For example, if your employer matches 50% of your contributions up to 6%, contributing enough to reach this limit ensures you’re not leaving money on the table. The employer match is an easy way to maximize your retirement savings, so take full advantage of this benefit. Resources like Fidelity’s 401(k) Savings Guide can help you understand how to optimize your contributions.

Tax Advantages to Enhance Your Savings

Another key benefit of employer-sponsored plans is the potential for tax advantages. Contributions to a 401(k) may be tax-deferred, meaning you don’t pay taxes on the money you contribute until you withdraw it in retirement. This allows your savings to grow without being taxed each year, accelerating the compound growth. Alternatively, some plans may offer Roth 401(k) options, where contributions are made after taxes but withdrawals are tax-free in retirement. By leveraging these tax advantages, you can keep more of your money working for you.

Professional Management for Your Investments

Many employer-sponsored plans offer access to professional investment management. These plans typically include a range of investment options, such as mutual funds, target-date funds, and index funds. For those who may not have the time or expertise to manage investments, professional management provides an easy way to ensure your retirement savings are growing. You can select the best options for your retirement goals, and in many cases, financial advisors are available to help guide your choices.

Balancing Multiple Financial Goals: Strategies for Success

Managing multiple financial goals can be challenging, especially when resources are limited. However, prioritizing your financial objectives based on your unique situation can help you make progress toward each goal. A well-structured plan allows you to focus on your most pressing needs while still building wealth for the future. Here are some strategies to help you balance your financial goals effectively.

Building an Emergency Fund

An emergency fund is a crucial first step in achieving financial stability. Having 3-6 months’ worth of living expenses saved will provide a safety net in case of unexpected events, such as job loss, medical emergencies, or major repairs. Begin by setting aside a small amount each month until you reach your target amount. It’s important to keep this fund separate from your regular savings to avoid dipping into it for non-emergencies. Once your emergency fund is established, you can shift focus to other financial goals with greater confidence. For tips on building an emergency fund, visit NerdWallet’s Emergency Fund Guide.

Paying Off High-Interest Debt

Before focusing exclusively on retirement savings, prioritize paying off high-interest debt. Credit card balances and payday loans often come with high-interest rates that can accumulate quickly. Paying off these debts frees up more money for saving and investing in the long run. Start with the highest-interest debt first (a method known as the “debt avalanche” approach), or if you’re motivated by quick wins, tackle the smallest debts first (the “debt snowball” approach). Reducing your debt load will give you more financial freedom and reduce stress, making it easier to focus on retirement and other goals.

Prioritizing Retirement Savings

Once your emergency fund is established and high-interest debt is managed, it’s time to focus on retirement savings. Retirement may feel far away, but the earlier you start, the more time your investments have to grow. Take advantage of employer-sponsored retirement plans like a 401(k), especially if your employer offers matching contributions. This “free money” is an opportunity you shouldn’t miss. Additionally, consider other retirement accounts, such as IRAs, to further boost your savings. By making retirement a priority, you’re securing your future while balancing current financial needs. For more information, visit Fidelity’s Retirement Savings Guide.

Risks of Non-Traditional Savings: Understanding the Limitations of Life Insurance Policies

While life insurance policies can provide some benefits as part of your retirement plan, they come with risks and limitations. These policies are often marketed as a dual-purpose tool for both life coverage and investment growth. However, before relying on them as a primary savings vehicle, it’s essential to understand the potential drawbacks that come with using life insurance for retirement.

Lower Returns Compared to Traditional Investment Accounts

One significant risk of using life insurance for retirement savings is the potentially lower returns it offers. Life insurance policies, particularly whole life or universal life policies, may include an investment component. However, the growth on these investments tends to be slower compared to more traditional accounts like 401(k)s or IRAs. Traditional investment vehicles often provide higher growth potential, especially over the long term, as they allow more aggressive investment strategies. Life insurance policies may offer more conservative growth, which may not be sufficient to meet your retirement goals, especially when factoring in inflation. For more details on traditional investment options, visit Vanguard’s Retirement Plans.

Complexity and Hidden Fees

Life insurance policies can also be quite complex and difficult to navigate. They often come with a range of fees and charges that can erode your investment over time. These fees may include administrative costs, surrender charges, and commissions for agents who sell the policies. Additionally, the structure of the policy may change depending on your age, health, and premium payments. Understanding the full cost of a life insurance policy and how its investment component works is critical. Unfortunately, many policyholders fail to realize how these costs impact their overall savings, leading to lower-than-expected returns. For guidance on understanding life insurance policies, consider resources like The National Association of Insurance Commissioners.

Limited Liquidity and Access to Funds

Another drawback of using life insurance as a savings tool is the limited liquidity it offers. While some policies allow you to borrow against the cash value, accessing funds may not always be easy or beneficial. There are typically restrictions on how much you can borrow or withdraw, and doing so may come with additional costs or interest charges. If you need to access your savings for an emergency or other financial need, these limitations could hinder your ability to use the funds when you need them most. Moreover, borrowing from your policy can reduce your death benefit, potentially impacting your beneficiaries.

Using Financial Tools: Empowering Your Retirement Planning

Financial planning tools and calculators are invaluable resources for anyone looking to manage their retirement savings effectively. By providing clarity and structure, these tools can help you make informed decisions about your financial future. Whether you’re just starting to save or you’re in the process of refining your plan, financial tools allow you to estimate needs, simulate scenarios, and track progress. Here’s how using these tools can improve your retirement planning.. For a detailed look at how to build your retirement savings, check out our guide on Alternative Retirement Plans and our How Long Will My Retirement Savings Last Calculator!.

Estimating Future Needs

One of the primary benefits of financial tools is the ability to estimate your future retirement needs. Calculators can help you project how much money you’ll need to cover expenses in retirement, based on your lifestyle, expected longevity, and other personal factors. You can input your current income, anticipated inflation rates, and desired retirement age to see how much you’ll need to save each month to reach your goals. These projections help you understand whether your current savings rate is sufficient or if you need to increase your contributions. By regularly adjusting these figures, you can make sure you’re on track to meet your financial needs in retirement. For assistance with this, check out resources like Fidelity’s Retirement Planning Calculator.

Modeling Different Scenarios

Another powerful feature of financial tools is the ability to model different investment scenarios. Simulating how various investment strategies might impact your retirement savings can give you a clearer picture of what to expect. Whether you choose to invest in stocks, bonds, or a diversified portfolio, these tools can show you how each option will affect your savings over time. You can test assumptions such as varying rates of return, contribution amounts, and retirement ages. By seeing the potential outcomes, you can make more informed decisions about how aggressive or conservative your investment strategy should be. This feature helps you identify the best approach for your situation and prepare for changes in the market.

Tracking Your Progress

Finally, financial tools can help you track your savings and investment performance over time. By monitoring your progress, you can adjust your strategy as needed to stay on target. Regularly reviewing your retirement accounts allows you to make changes, such as reallocating investments or increasing contributions, if necessary. You can also assess whether your spending is on track or if adjustments are needed to boost savings. Tracking helps you stay accountable and motivated, ensuring that your retirement goals remain within reach. For a comprehensive tool to manage your retirement progress, visit Personal Capital’s Retirement Planner.

In conclusion, utilizing financial tools is essential for effective retirement planning. By estimating your future needs, simulating different investment strategies, and tracking your progress, you can make informed decisions that support your long-term goals. These tools provide valuable insights that help ensure you are saving enough and investing wisely. Regularly reviewing and adjusting your plan based on these insights will keep you on track to achieve financial security in retirement. With the right planning tools and expert guidance, you can confidently move forward toward a successful retirement.

1 thought on “Saving Strategies by Age”